Deda Machinery was established in 1994. It has more than 20 years of professional experience and is engaged in the design, development and manufacture of automatic tool change mechanisms.

01 Overview of machine tool industry development

1. Concept and status

Machine tools, also known as "industrial mother machines", are machines used to manufacture machines. Since machines and equipment need to be processed and manufactured by machine tools on metal or other material blanks, machine tools are also called "industrial mother machines", which are the general starting point for the precision, efficiency and quality of all manufacturing in a country.

2. Classification

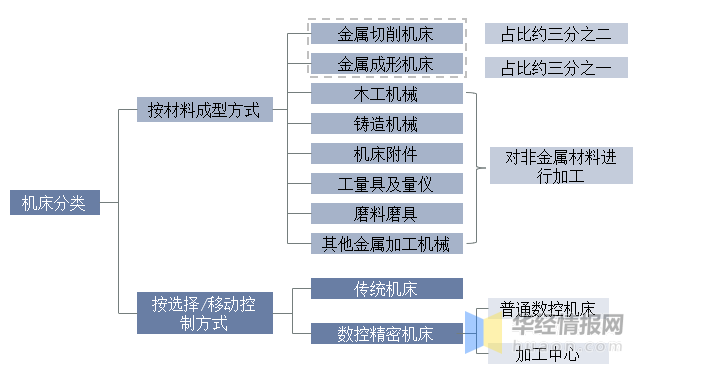

There are many types of machine tools. According to the material forming method, machine tools can be mainly divided into eight sub-sectors: metal cutting machine tools, metal forming machine tools, foundry machinery, woodworking machinery, machine tool accessories, measuring tools and measuring instruments, abrasives and other metal processing machinery. Among them, metal cutting machine tools are the most widely used and the largest number of machine tool categories. Generally speaking, machine tools in the narrow sense refer to metal cutting machine tools. Metal cutting machine tools refer to machine tools that process various metal workpieces by cutting, grinding or special processing methods to obtain the required geometric shape, dimensional accuracy and surface quality; according to the classification of machine tool control systems, machine tools can be mainly divided into traditional machine tools And CNC precision machine tools.

3. Development history

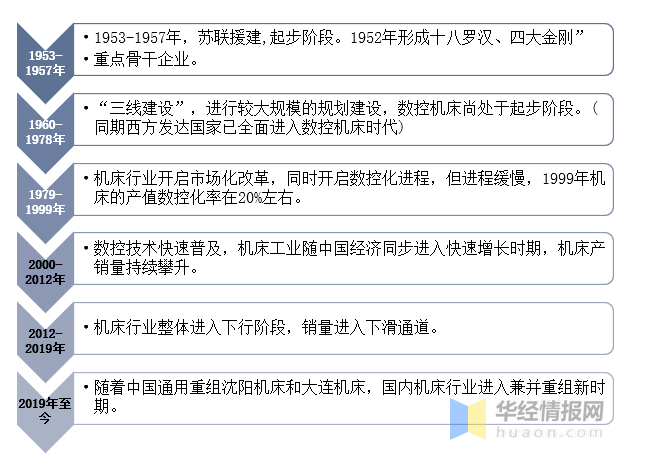

In 1952, the First Ministry of Machinery Industry rebuilt and built eighteen machine tool factories, commonly known as "Eighteen Arhats", which played a pivotal role in China's industrial development. However, under the background of the planned economy, the relatively single structure and rigid management mode make local machine tool state-owned enterprises unable to adapt to the rapidly changing market demand, resulting in most of them being merged, acquired or reorganized, indicating that the existing machine tool system has reached At the end, a whole new system needs to be reconstructed.

02 Industry Chain of Machine Tool Industry

1. Schematic diagram of the industrial chain

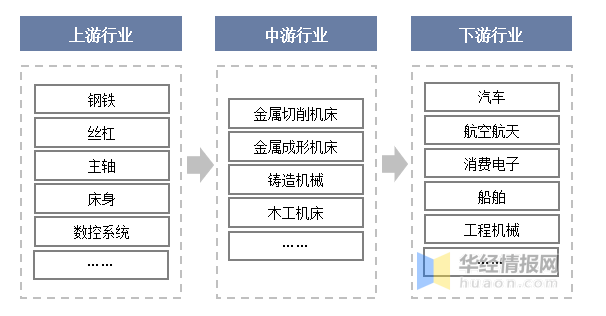

The upper, middle and lower reaches of the machine tool industry chain are clear, including upstream basic material and component manufacturers, midstream machine tool manufacturers and downstream end users. Upstream basic material and component manufacturers mainly provide machine tool manufacturers with structural parts (cast iron, steel parts, etc.), transmission systems (guide rails, screw screws, spindles, etc.), CNC systems, etc., and the companies involved mainly include FANUC and Siemens , Heidenhain, Mitsubishi, etc.; the midstream is machine tool manufacturers, responsible for providing end users with various machine tools or complete sets of integrated products that meet their requirements; the downstream is mainly in the fields of automobiles, consumer electronics, aerospace, ships, and engineering machinery.

2. Cost

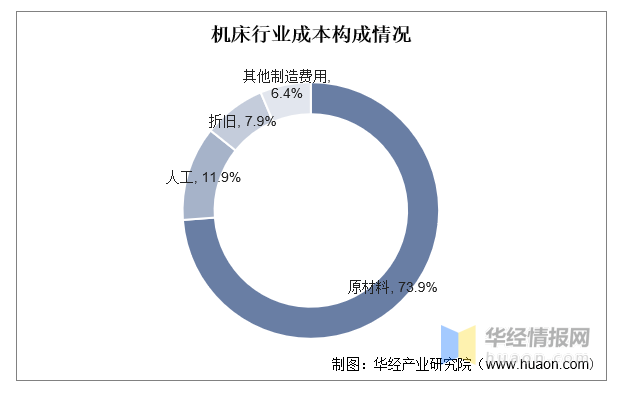

In the machine tool production process, raw material costs accounted for the highest proportion of 73.9%, followed by labor, depreciation and other manufacturing costs, accounting for 11.9%, 7.9% and 6.4% respectively. Usually, companies with scale advantages can enjoy discounts corresponding to the purchase scale when purchasing raw materials, which can effectively increase the company's gross profit margin.

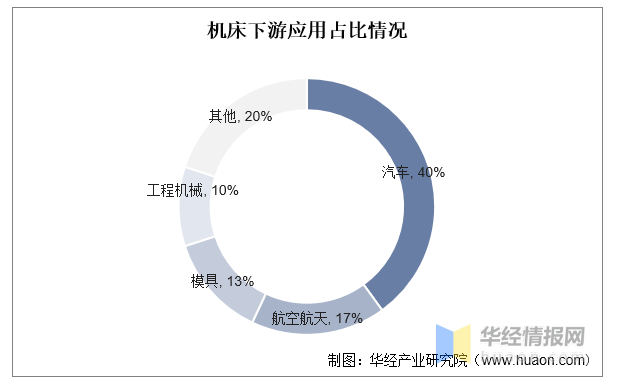

3. Downstream applications

As the industrial mother machine of high-end equipment manufacturing industry, machine tools have a wide range of downstream industries. Downstream applications include automotive, aerospace, mold, construction machinery and many other industries.

Related report: "2022-2027 China Machine Tool Industry Development Trend Forecast and Investment Strategy Research Report" issued by Huajing Industrial Research Institute

03 Development status of the global machine tool industry

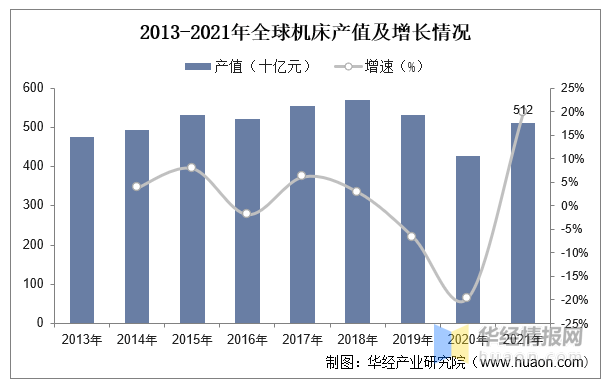

1. Output value

According to VDW (German Machine Tool Manufacturers Association) data, from 2013 to 2021, the global machine tool output value showed a fluctuating trend. Thanks to the recovery of the global economy after the epidemic, the global machine tool output value in 2021 will be about 512 billion yuan, a year-on-year increase of 20%. .

2. Regional distribution of production and consumption

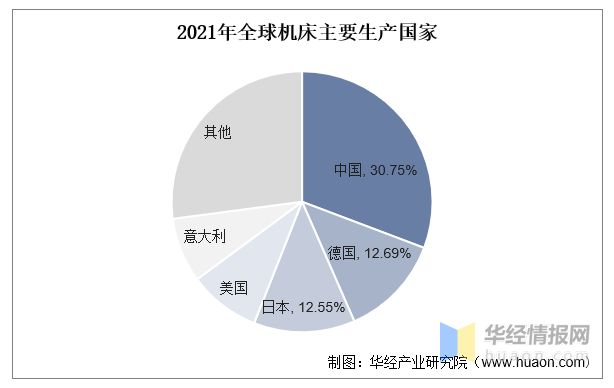

China is the world's largest market for machine tool production and consumption. In 2021, the output value of the global machine tool industry is about 512 billion yuan, of which my country's output value is 157.39 billion yuan, accounting for 30.75%, ranking first; followed by Germany and Japan, with market shares of 12.69% and 12.55% respectively.

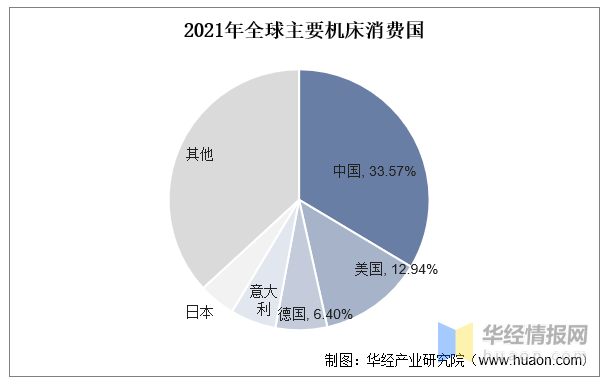

From the perspective of the machine tool demand market, China's consumption will rank first in the world in 2021, accounting for 33.57% of the global demand market. The consumption in the United States and Germany accounted for 12.94% and 6.4% respectively, ranking second and third in the world respectively.

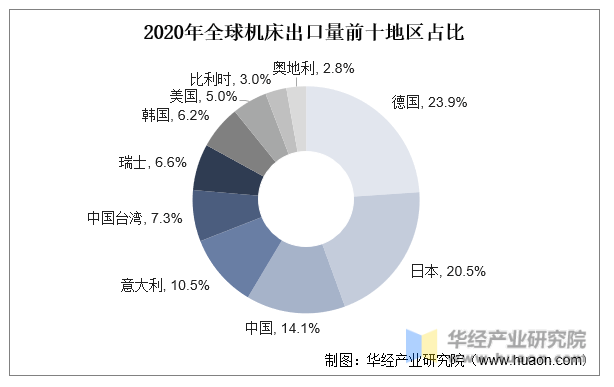

3. Export distribution

German and Japanese companies dominate the global high-end market, China's machine tool exports are mainly low-end, and the localization rate of high-end machine tools is low. The machine tool industry is completely competitive. Germany, Japan, and the United States are the main machine tool countries. Overseas brands are in a leading position in terms of technology, scale, and brand influence. From the perspective of export volume, Germany and Japan account for about 45% of the global market.

04 Development status of China's machine tool industry

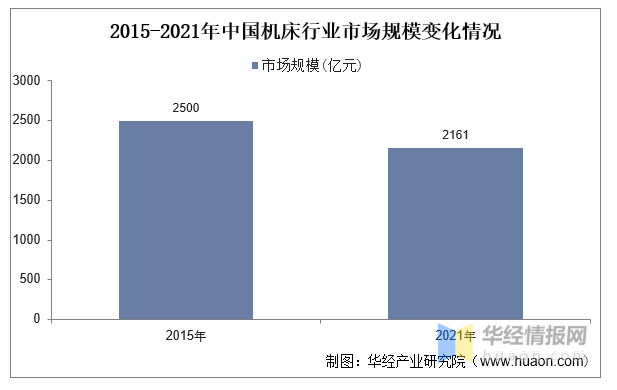

1. Market size

my country's machine tool market, with a scale of 100 billion yuan, is in a period of downward adjustment in recent years. Affected by fluctuations in the prosperity of the downstream manufacturing industry and the replacement cycle, my country's machine tool industry is in a downward adjustment period. The market size has dropped from about 250 billion in 2015 to about 216.1 billion in 2021, but the overall scale is still considerable.

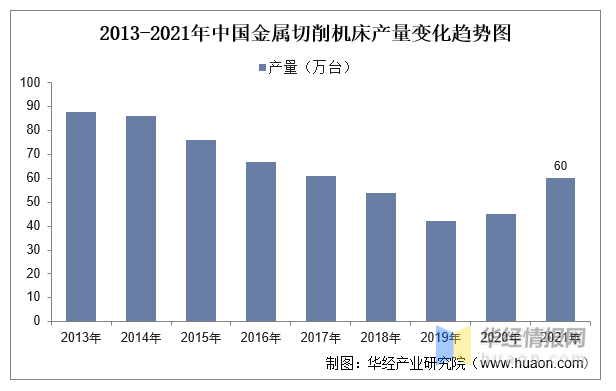

2. Output

my country's machine tool industry is mainly divided into two major markets: metal cutting machine tools and metal forming machine tools. Among them, metal cutting machine tools are the main machine tool category, and its output changes are the epitome of each stage of the development of my country's manufacturing industry. With the rapid increase in the stock of machine tools, the machine tool industry has entered a low tide period from 2015 to 2019. In 2019, the output of metal cutting machine tools was 416,000 units. Since 2020, the output of metal cutting machine tools has shown a bottom-up trend. On the one hand, it has benefited from overseas demand after the epidemic to stimulate exports and promote the rapid recovery of the manufacturing industry. On the other hand, it has formed a resonance with the machine tool update cycle. In 2021, the output of metal cutting machine tools in my country will increase to 602,000 units, an increase of about 150,000 units compared to 2020.

05 Development Policy of Machine Tool Industry

In recent years, policies have frequently released positive signals, and the emphasis on industrial master machines has gradually increased. Before 2019, the policies for the industrial machine tool industry were mainly directional and conceptual guidelines, including setting standards for CNC machine tools, identifying them as strategic industrial projects, and listing them in the encouraged industries in the guidance catalog for industrial restructuring, such as "Made in China 2025" "List high-end CNC machine tools as one of the key development areas of the manufacturing industry in the next ten years. At the same time, it is clear that by 2025, the domestic market share of high-end CNC machine tools and basic manufacturing equipment will exceed 80%; after 2019, the policy will support the industrial machine tool industry. The policy is more specific, and the policy position is constantly improving. Specifically, in September 2021, the enlarged meeting of the Party Committee of the State-owned Assets Supervision and Administration Commission proposed to strengthen the public relations of key core technologies for industrial mother machines; in December, the "14th Five-Year" Smart Manufacturing Development Plan was issued. , and support industrial machine tools as a key area, and propose to develop intelligent vertical/horizontal five-axis machining centers, turning-milling compound machining centers, high-precision CNC grinding machines and other machine tools. By 2025, manufacturing enterprises above designated size will basically popularize digitalization. Backbone enterprises in key industries have initially realized intelligent transformation; in September this year, the Ministry of Industry and Information Technology stated in a press conference that the top-level design of the industrial machine tool industry is in progress.

06 Machine tool industry market competition landscape

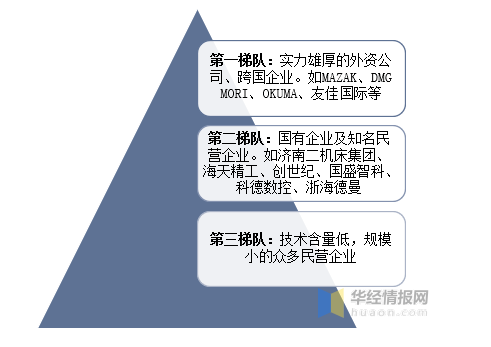

1. Competition echelon

Driven by military industry, new energy vehicles, photovoltaics, wind power, construction machinery, and marine engineering, China's machine tool industry is expected to accelerate the pace of import substitution in the field of high-end machine tools. In the existing competition pattern of the machine tool industry, the first echelon is the powerful foreign-funded enterprises and multinational companies, including MAZAK, DMG MORI, OKUMA, Youjia International, etc., whose products are concentrated in high-end CNC machine tools. The second echelon is large state-owned enterprises and private enterprises with certain popularity and technical strength, including Jinan No. 2 Machine Tool Group, Haitian Precision, Genesis, Guosheng Zhike, Kede CNC, and Zhejiang Heideman. The products are concentrated in mid-end machine tools. The third echelon is many private enterprises with low technical content and small scale, concentrated in low-end machine tools.

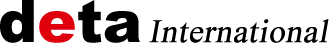

2. Ranking of Machine Tool Business Revenue

Since 2012, with the transfer and upgrading of the domestic manufacturing industry, the machine tool industry has entered a down cycle and competition has intensified. Significant changes have taken place in the market demand structure, and the market demand for low-end general-purpose machine tools has dropped sharply; the market demand for mid-to-high-end, customized, and automated complete sets of machine tools has grown rapidly. This change has formed an obvious dislocation with the supply structure of the domestic machine tool industry. Take advantage of product advantages to quickly seize the domestic high-end market share. Due to the challenge of foreign advanced machine tools and the impact of the market economy, the industrial structure has undergone major changes. In recent years, a number of private enterprises represented by Genesis, Haitian Precision, and Qiaofeng Intelligent have emerged in China to seize the opportunity of transformation and upgrading, and are committed to creating domestically produced mid-to-high-end CNC machine tools, constantly breaking through and mastering the core technology of mid-to-high-end CNC machine tools, And it has been widely recognized by the market, its comprehensive competitiveness has been greatly improved, and it has gradually become a backbone enterprise in my country's machine tool industry.

07 Development Trend of Machine Tool Industry

1. The rate of numerical control continues to increase

Compared with ordinary machine tools, CNC machine tools have outstanding advantages in terms of processing accuracy, processing efficiency, processing capacity and maintenance. With the transformation and upgrading of my country's manufacturing industry, driven by the increasing demand for processing precision, the penetration of CNC machine tools in my country The rate is increasing year by year, but there is still a big gap with the level of numerical control rate in developed countries. The "Made in China 2025" strategic program clearly stated: "In 2025, the numerical control rate of China's key processes will increase from the current 33% to 64%". Under the influence of factors such as policy encouragement, economic development and industrial upgrading, my country's CNC machine tool industry will usher in a broad space for development in the future.

2. Import substitution in high-end CNC machine tool market

From the perspective of application fields, the application scope of high-end machine tools covers key pillar industries related to national security such as energy, aerospace, military industry, and ships. machine tool needs. From the perspective of the overall development of my country's manufacturing industry, it is currently changing from a "manufacturing power" to a "manufacturing power". The proportion of demand for high-end CNC machine tools with high precision and high value will also increase. At present, western countries have imposed strict controls on the export of high-end CNC machine tools and technologies to my country, which has caused my country to face the problem of "stuck neck" in the high-end CNC machine tool industry, and Sino-US trade frictions have exacerbated this situation, further accelerating my country's promotion of high-end machine tools The process of localization and the realization of independent and controllable high-end products. In recent years, a number of private enterprises with certain core technologies have emerged in the domestic mid-to-high-end CNC machine tool market. In the future, they will follow the wave of localization substitution and further expand the high-end market share.

3. Improve self-sufficiency of core components

The core components of CNC machine tools mainly include CNC systems, spindles, screw rods, line rails, etc. At present, there is a certain gap between the technology of domestic core components and the international level. International brands are the mainstay, the localization rate is low, and the dependence on international brand components is high. In particular, the CNC systems supporting high-end CNC machine tools are basically monopolized by overseas manufacturers such as FANUC and Siemens. "<Made in China 2025> Technology Roadmap for Key Areas" puts forward a clear plan for the localization of core components of CNC machine tools: by 2025, the domestic market share of standard and intelligent CNC systems will reach 80% and 30% respectively; The domestic market share of medium and high-end functional components such as rods and line rails has reached 80%; high-end CNC machine tools and basic manufacturing equipment have generally entered the ranks of world powers. At present, a number of domestic machine tool companies including the company are constantly breaking through and mastering core component technologies. With the strong support of national policies and the continuous improvement of the level of independent research and development of domestic medium and high-end machine tools, the self-sufficiency of core machine tool components in my country is expected to be further improved.

Home

Home Products

Products Telephone

Telephone Message

Message